Unclaimed Lifafa has become a trending topic recently, sparking curiosity among many who wonder what it is, how to check it, and whether they can claim it. This guide explains everything in a simple, easy-to-understand manner, helping you navigate the process and understand all key details about Unclaimed Lifafa without any confusion.

Whether you are a curious reader, someone who came across this while browsing, or an individual who thinks they might be eligible for such a scheme, this blog is your one-stop destination.

What is Unclaimed Lifafa?

“Lifafa” traditionally means an envelope in Hindi, often associated with gifts, cash, or something of value. When connected with the term Unclaimed Lifafa, it generally refers to:

- Money, funds, or benefits that were meant for individuals but have not been claimed yet.

- Schemes or digital initiatives where rewards, refunds, or compensations are put aside for eligible users but remain untouched.

- Financial tools where old or dormant accounts have money stored, waiting to be transferred to rightful owners.

In 2025, Unclaimed Lifafa has become a trending topic due to new digital schemes, banking settlements, and awareness campaigns.

Also Read

Why Does Unclaimed Lifafa Exist?

There are several reasons why such unclaimed funds or lifafas come into existence:

- Unawareness – Many people do not know they are eligible for benefits.

- Incomplete KYC or Verification – Pending verification prevents the transfer.

- Dormant Accounts – Old accounts with small balances left behind.

- Refunds & Settlements – Overpayments, cashback, or compensations not claimed.

- Inheritance & Legal Delays – Money left unclaimed due to lack of documentation.

Types of Unclaimed Lifafa

| Category | Description | Examples |

|---|---|---|

| Banking Lifafa | Money left in dormant or inactive accounts. | Old savings accounts, FD renewals not claimed |

| Government Schemes | Subsidies or benefits credited but uncollected. | Gas subsidy, pension, scholarship amounts |

| Digital Lifafa | Rewards or cashback in e-wallets that go unclaimed. | UPI cashback, app rewards |

| Corporate/Company Funds | Compensation or refunds not taken by employees or customers. | PF claims, insurance refunds |

| Inheritance Lifafa | Property or funds not claimed by family members due to lack of awareness. | Legal heir funds, nominee accounts |

How to Check Your Unclaimed Lifafa

Checking if you have an Unclaimed Lifafa in 2025 has become easier with digital integration. Here are the most common methods:

- Bank Websites and Apps

- Visit your bank’s official site.

- Check the “Unclaimed Deposits” section.

- Enter basic details like account number, PAN, or name.

- Government Portals

- Use state/national government portals for subsidies and pensions.

- Many schemes have dedicated “claim” sections.

- Insurance & Provident Fund Sites

- Check unclaimed PF or insurance maturity claims.

- Use your UAN (Universal Account Number) for PF search.

- Digital Wallets

- Login to Paytm, Google Pay, or PhonePe.

- Check your reward history and cashback sections.

- Centralized Financial Search

- In 2025, initiatives are underway to create a single platform where citizens can track unclaimed funds across banks, insurance, and government schemes.

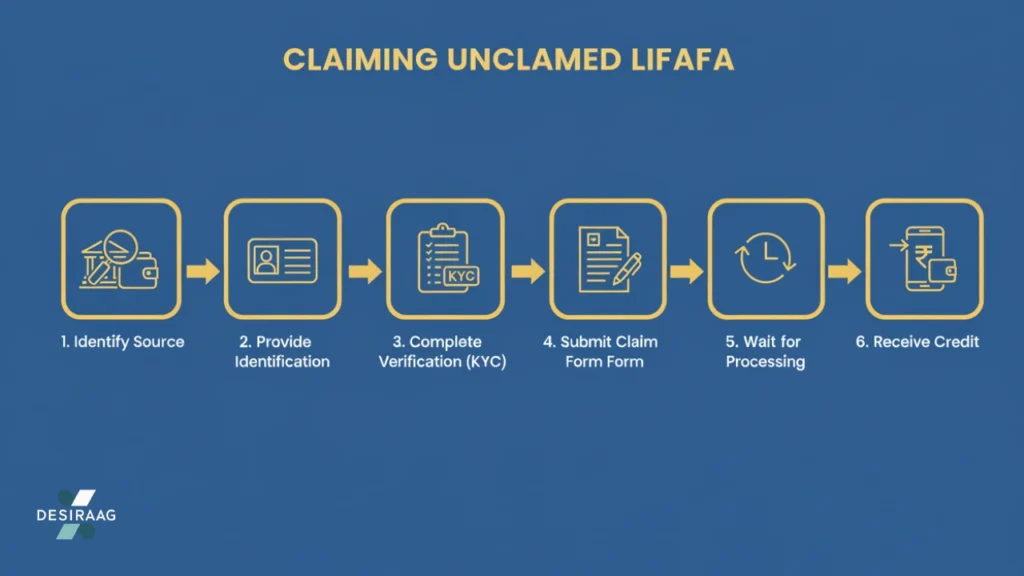

Step-by-Step Guide to Claim Your Lifafa

Here’s a simple process most platforms follow:

- Identify the Source – Whether it’s a bank, government scheme, or digital wallet.

- Provide Identification – Use PAN, Aadhaar, or account details.

- Complete Verification – Submit KYC or nominee details.

- Submit a Claim Form – Online or offline depending on the scheme.

- Wait for Processing – Usually 7–30 working days.

- Receive Credit – Funds are transferred to your verified bank account.

Advantages of Claiming Unclaimed Lifafa

- Financial Benefit – You receive money that is rightfully yours.

- Security – Prevents funds from being misused or permanently lost.

- Legal Protection – Helps in inheritance or nominee claims.

- Digital Convenience – Many processes can be completed online in 2025.

- Awareness Boost – Increases financial literacy among citizens.

Disadvantages or Challenges

While the idea of Unclaimed Lifafa is attractive, it also has its drawbacks:

- Scams and Frauds – Fake websites promising “lifafa claims” can trick users.

- Complex Process – Some claims require heavy paperwork and long waits.

- Limited Awareness – Many people still don’t know such platforms exist.

- Legal Disputes – Inheritance claims may cause family conflicts.

- Time-Consuming – Verification can take weeks to months in certain cases.

Tips to Avoid Missing Your Lifafa

- Always update your KYC details with banks and financial institutions.

- Check your digital wallets regularly.

- Ensure nominee details are updated for bank accounts, FDs, and insurance.

- Respond promptly to notifications from your bank or government portals.

- Educate family members about claiming benefits to avoid future delays.

Common Myths About Unclaimed Lifafa

| Myth | Reality |

|---|---|

| It is free money given by the government. | It is usually your own money waiting to be claimed. |

| Anyone can claim it. | Only verified individuals or nominees can. |

| It is a scam. | While scams exist, official platforms are safe. |

| Only big amounts get listed. | Even small cashback or subsidies can appear. |

| It is difficult to track. | In 2025, digital tools have made it easier. |

Future of Unclaimed Lifafa in 2025 and Beyond

The concept of Unclaimed Lifafa is expected to expand further:

- Centralized Databases – One-stop platforms to track all unclaimed money.

- AI-Powered Alerts – Automated notifications sent to users about pending claims.

- Integration with Aadhaar & PAN – Seamless tracking through national IDs.

- More Digital Wallet Tie-ups – Cashback and rewards made easier to claim.

- Public Awareness Campaigns – Governments and banks encouraging people to check regularly.

FAQs on Unclaimed Lifafa

1. What exactly is Unclaimed Lifafa?

It refers to unclaimed money, benefits, or funds in banks, wallets, or government schemes.

2. How can I check if I have any Unclaimed Lifafa in 2025?

You can check through your bank website, digital wallets, or government claim portals.

3. Is it safe to claim Unclaimed Lifafa online?

Yes, as long as you use official portals and avoid third-party scam sites.

4. What documents are needed to claim?

Usually Aadhaar, PAN, account details, and sometimes nominee information.

5. What happens if I never claim my Lifafa?

Funds may eventually be transferred to central reserves, but some platforms allow late claims.

6. Can NRIs also claim Unclaimed Lifafa?

Yes, NRIs can claim through online platforms, provided they submit proper KYC and proof.

7. Are there any charges for claiming?

Official portals do not charge, but intermediaries may demand service fees.

Final Thoughts

The Unclaimed Lifafa 2025 is not a mystery but a reminder of how much money often goes unnoticed. With the rise of digital banking and e-governance, tracking these funds has become simpler than ever. The key is to stay alert, use only trusted platforms, and claim what is rightfully yours.

So, before you move on, take a moment to check if you have an Unclaimed Lifafa waiting for you—it might just surprise you.